ORYZON Reports Results for Quarter Ended September 30, 2020 and Provides Corporate Update

MADRID, SPAIN and CAMBRIDGE, MA, UNITED STATES, October 26th, 2020 – Oryzon Genomics, S.A. (ISIN Code: ES0167733015, ORY), a clinical-stage biopharmaceutical company leveraging epigenetics to develop therapies in diseases with strong unmet medical need, today reported financial results for the third quarter of 2020 and provided an update on recent developments.

Dr Carlos Buesa, Oryzon’s Chief Executive Officer, said: “Oryzon has successfully focused on the execution of its ongoing clinical trials and preparation for upcoming studies in the third quarter. These continue to make good progress despite the continuing disruption caused by Covid-19 around the world. Funding for our ongoing and planned trials was already in place, and the financing we carried out in June has allowed for greater focus on our current clinical activities by extending our cash runway until H1 2023.”

Third Quarter and Recent Highlights

Iadademstat in oncology:

- SCLC. Pre-final data of the Phase II trial CLEPSIDRA, investigating iadademstat in combination with standard-of-care platinum-etoposide in relapsed extensive disease (ED) small cell lung cancer (SCLC) patients, was presented at the virtual ESMO conference:

- The triple combination of iadademstat plus carboplatin-etoposide produced an objective response rate of 40% and mean average response of 4.5 months. Additionally, long-lasting stable disease (>4 months) was reported in two patients, yielding an average composite clinical benefit rate of 60%.

- One patient showed a sustained therapeutic benefit when treated with iadademstat alone, confirming previously reported preclinical efficacy of iadademstat monotherapy in PDX models from relapsed chemo-resistant patients.

- Hematological toxicity suggests combination therapy with carboplatin-etoposide is not suitable for second line SCLC patients, but iadademstat safety and efficacy profile suggests potential for monotherapy or combination with other non-hematotoxic agents.

- AML. A highly relevant scientific paper was published by company scientists together with clinical investigators from leading hospitals around Europe in the peer-reviewed international medical journal, Journal of Clinical Oncology. This paper reported data from the Phase I/IIa clinical trial in refractory or relapsed acute myeloid leukemia (AML), showing that iadademstat has a good safety profile together with signs of clinical and biological activity as a single agent in AML.

Vafidemstat in neurological and inflammatory disease

- Personalized Medicine. The precision medicine collaboration with the Institute of Medical and Molecular Genetics (INGEMM) of the La Paz University Hospital in Madrid in patients with Phelan-McDermid Syndrome (PMS) was initiated despite restrictions associated with the Covid-19. The first patients have been monitored for functional impairment using a set of diverse validated scales in the field. These activities will continue with more genetically characterized PMS patients and are expected to be concluded by 1Q 2021. The aim is that this cognitive, behavioral and functional baseline assessment of PMS patients will inform a future clinical study with vafidemstat.

- Covid-19. The ongoing study in severe Covid-19 patients, named ESCAPE, continues recruitment. This is an open-label, randomized, double arm Phase II trial to assess the efficacy and tolerability of vafidemstat in combination with standard of care, to prevent progression to Acute Respiratory Distress Syndrome (ARDS). The study will enroll 20 patients per arm. The company recently opened Hospital La Princesa in Madrid as a third site and has just been granted approval from the Spanish Medicines Agency (AEMPS) to open three additional clinical sites to accelerate recruitment: Hospital La Paz in Madrid, Hospital Universitario de Getafe and Hospital Universitari Mútua de Terrassa.

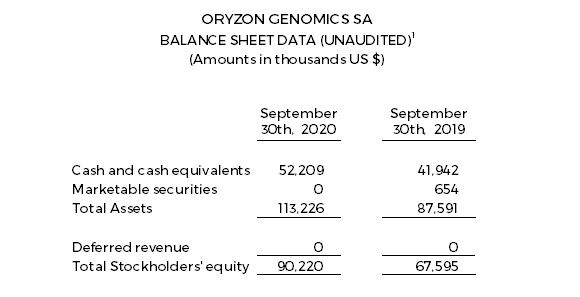

Financial Update: Third Quarter 2020 Financial Results

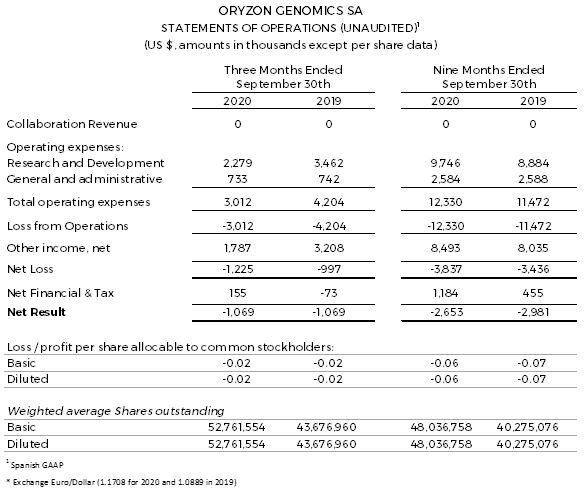

Research and development (R&D) expenses were $2.3 and $9.7 million, respectively, for the quarter and 9 months ended September 30, 2020, compared to $3.5 and $8.9 million, respectively, for the quarter and 9 months ended September 30, 2019. The $0.8 million increase was driven primarily by expenses associated with advancing the company’s clinical trials.

General and administrative expenses were $0.7 and $2.6 million, respectively, for the quarter and 9 months ended September 30, 2020, at same level of expenses for the quarter and 9 months ended September 2019.

Net losses were $1.2 and $3.8 million, respectively, for the quarter and 9 months ended September 30, 2020, compared to net losses of $1.0 and $3.4 million, respectively, for quarter and 9 months ended September 2019.

Negative net result of $2.7 million (-$0.06 per share) for the 9 months ended September 30, 2020, compared to a negative net result of $3.0 million for the 9 months ended September 30, 2019.

Cash, cash equivalents and marketable securities totaled $52.2 million as of September 30, 2020, compared to $42.6 million as of September 30, 2019.

About Oryzon

Founded in 2000 in Barcelona, Spain, Oryzon (ISIN Code: ES0167733015) is a clinical stage biopharmaceutical company considered as the European champion in Epigenetics. Oryzon has one of the strongest portfolios in the field. Oryzon’s LSD1 program has rendered two compounds, vafidemstat and iadademstat, in clinical trials. In addition, Oryzon has ongoing programs for developing inhibitors against other epigenetic targets. Oryzon has a strong technological platform for biomarker identification and performs biomarker and target validation for a variety of malignant and neurological diseases. Oryzon has offices in Spain and the United States. For more information, visit

FORWARD-LOOKING STATEMENTS

This communication contains, or may contain, forward-looking information and statements about Oryzon, including financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, capital expenditures, synergies, products and services, and statements regarding future performance. Forward-looking statements are statements that are not historical facts and are generally identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although Oryzon believes that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Oryzon shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Oryzon that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the documents sent by Oryzon to the Spanish Comisión Nacional del Mercado de Valores (CNMV), which are accessible to the public. Forward-looking statements are not guarantees of future performance and have not been reviewed by the auditors of Oryzon. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date they were made. All subsequent oral or written forward-looking statements attributable to Oryzon or any of its members, directors, officers, employees or any persons acting on its behalf are expressly qualified in their entirety by the cautionary statement above. All forward-looking statements included herein are based on information available to Oryzon on the date hereof. Except as required by applicable law, Oryzon does not undertake any obligation to publicly update or revise any forward‐looking statements, whether as a result of new information, future events or otherwise. This press release is not an offer of securities for sale in the United States or any other jurisdiction. Oryzon’s securities may not be offered or sold in the United States absent registration or an exemption from registration. Any public offering of Oryzon’s securities to be made in the United States will be made by means of a prospectus that may be obtained from Oryzon or the selling security holder, as applicable, that will contain detailed information about Oryzon and management, as well as financial statements.